How do I get out of secured debt?

Nov 07, 2024 By Vicky Louisa

A new trend is making waves in the dynamics of company finance. Secured debt, which has been the fulcrum around which corporate borrowing revolved, is now beginning to be shunned by companies. This factor alters how businesses look at their capital structures and debt management policies.

Secured Debt Is Losing Favor Among Corporations

The Shift Away from Secured Financing

The past two years have witnessed a movement away from secured debt in companies as a form of borrowing. This phenomenon tends to indicate a sea change within the corporate finance system. When one's assets become securities for paying back, secured debt has always been a darling for businesses when they have to raise cash. Times are slowly changing as companies look out for less limiting forms of borrowing.

Reasons Behind the Declining Popularity

Several factors contribute to the waning interest in secured debt among corporations:

- Flexibility concerns: Secured debt has its strings, which, for a company, may reduce some operational freedom.

- Asset preservation: Companies are reluctant to pledge any important assets as security.

- Market conditions: Low interest rates have made Unsecured borrowing more alluring.

- Strategic agility: Firms want financing routes enabling quick inversion if the market becomes turbulent.

The Rise of Alternative Financing Options

As secured debt loses ground, other forms of financing are gaining ground for corporations, including:

- Unsecured bonds

- Revolving credit facilities

- Private placements

- Green bonds and sustainability-linked loans

Implications for Corporate Finance

This move away from secured debt is a reshaping of the corporate finance strategies. Companies now try to keep a good credit rating so unsecured financing would be available opportunistically. They are also diversifying their funding sources to reduce dependency on any one source of debt. As this continues, it will likely make some difference in how corporations structure their balance sheet and manage their financial risks over the next few years.

The Rise of Unsecured Corporate Bonds

Shift in Corporate Financing Strategies

Over the past few years, the corporate debt structure has changed dramatically. Companies are increasingly turning to unsecured corporate bonds as the most desired mode of financing, turning the conventional secured debt pattern upside down. Uncertainty created by the economy is changing the dynamics of the market, and it is part of corporate strategy for the current time.

Advantages of Unsecured Bonds

Unsecured bonds also facilitate more flexibility in corporate financial operations as no particular asset is to be pledged against such bonds. In this case, firms maintain better control over their balance sheets. Therefore, with better agility due to changes in the market, companies can grasp such opportunities when they present themselves. Further, unsecured bonds offer fewer restrictive covenants, giving a corporation more room in its decision-making process.

Market Perception and Investor Appetite

The popularity of unsecured corporate bonds also rides on changing investor sentiment. Investors shun ultra-low returns for slightly higher risk in low-interest rates. This surge in appetite for risk has become a robust market for unsecured corporate debt, allowing companies to reach out and raise these types of capital at competitive rates but without sacrificing their asset base.

Impact on Corporate Financial Health

Though the trend of unsecured bonds is promising in many ways, it is not easy. The firms must maintain their debt profiles to have sufficient credit ratings and investor confidence. The increasing trend of unsecured debt obligations has made many corporations emphasize appropriate financial ratios and reporting mechanisms. This has often resulted in greater overall financial discipline and a more focused approach toward long-term planning.

The Risks and Benefits of Unsecured Debt

Understanding Unsecured Debt

Unsecured debt, unlike its secured counterpart, does not require security. Due to its availability and flexibility, it has become one of the significant forms of finance for companies. However, it is imperative to comprehend its advantages and shortcomings before making a financial decision.

Benefits of Unsecured Debt

One of the primary merits of unsecured debt entails the speed and ease with which the company borrows. Since asset valuation or complex legal arrangements are not necessary, the corporation may, in this light, potentially have quicker access to money. The unsecured debt also allows more flexibility in its usage; internally, the firm has more freedom regarding where the funds are deployed without constraints derived from asset-based security positions.

Risks Associated with Unsecured Debt

While unsecured debt certainly has attractive perks, several risks are also involved. Most often, the most significant concern is paying much higher interest rates. To balance the increased risk involved, lenders may charge more, which can impact the profitability of the borrowing company.

Strategic Considerations

Against any disadvantages, the company has to weigh the advantages of unsecured debt. It will have to think about its complete financial picture and foresee cash flow and long-term goals, which are iterative. Unsecured debt points out the absence of the time-consuming knowledge of the creditorwhich may be beneficial if this grants instant access to money for seizing rapid opportunities for growth or for short-term needshowever, such benefit should always be weighed against the risks and extra costs from that type of finance.

What This Means for The Future of Corporate Finance

This is flipping the corporate finance landscape from companies secured by debt to debt unsecured, from the debt security model to the debt unsecured model, and identifying the ways companies finance and operate in a manner so full of risk. The carrying capacity has a wide range of applications to businesses, investors, and the economic environment.

Increased Flexibility for Corporations

Because of this, companies are given more flexibility in their financial activities. The ability of companies to stay in complete control of their assets represents far more freedom in how they can react to market conditions and take advantage of growth opportunities. However, I also hope it will generate new freedom for business models and strategic investment innovation that can propel economic growth and create jobs.

Evolving Risk Assessment Practices

Since secured debt is shrinking, lenders must change how they consider a corporation's creditworthiness. Moving away from traditional collateral-based analysis means crossing the barrier into more sophisticated risk analysis techniques. Lenders will ask more about market positioning and quality of management, which will put more stress on cash flow projections. Thus, this trend may also help foster creative financial technologies and data analytics, further matching corporate health and prognosis.

Conclusion

You might have gathered that the movement of corporations away from secured debt is quite clear. How the market dynamics, risk appetites, and financing strategies have changed tells it all. While secured debt still finds applications, unsecured financing implies greater flexibility and coherence with many companies' priorities.

On this page

Secured Debt Is Losing Favor Among Corporations The Shift Away from Secured Financing Reasons Behind the Declining Popularity The Rise of Alternative Financing Options Implications for Corporate Finance The Rise of Unsecured Corporate Bonds Shift in Corporate Financing Strategies Advantages of Unsecured Bonds Market Perception and Investor Appetite Impact on Corporate Financial Health The Risks and Benefits of Unsecured Debt Understanding Unsecured Debt Benefits of Unsecured Debt Risks Associated with Unsecured Debt Strategic Considerations What This Means for The Future of Corporate Finance Increased Flexibility for Corporations Evolving Risk Assessment Practices Conclusion

How Economic Volatility Affects Your Investment Portfolio

Funding Home Improvements: Qualifying for an FHA Loan

Understand and Learn: How Pawnshops Make Money?

5 Life Insurance Options You Should Consider

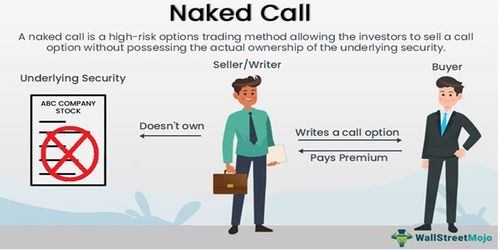

Naked Call Writing: A Comprehensive Guide

Other benefits of CBDC that the central bank has taken into account

Gross Debt Service Ratio

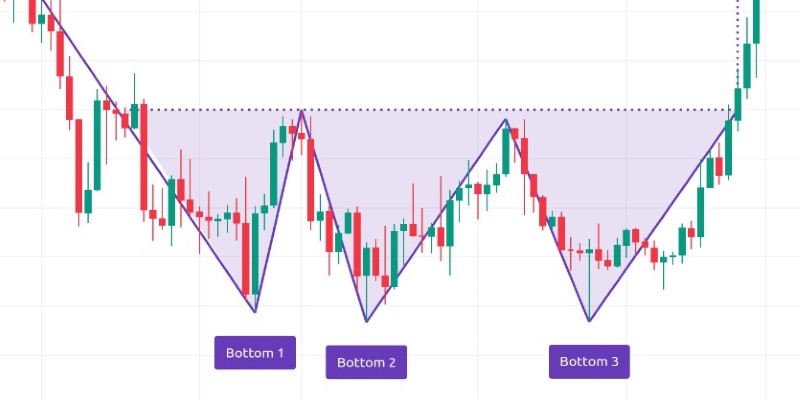

From Bearish to Bullish: How to Trade the Triple Bottom Chart Formation

10 Ways to Improve Your Credit Score After a Foreclosure

Explain in Detail: What Is a Financial Planner?

6 Ways to Get a Free Google Ads Promo Code in 2024 – A Comprehensive Guide