Understand and Learn: How Pawnshops Make Money?

Feb 27, 2024 By Susan Kelly

Introduction

How Pawnshops Make Money? Many individuals have the impression that these locations are involved in some questionable activity. However, if you've never gone to a pawnshop before, you might be missing out on some fantastic deals. Pawnshops are known for their low prices. A pawnshop is similar to a combination of a dozen garage sales and a flea market in a single location. Pawnshops are essential to the functioning of many communities because they enable residents to obtain short-term financial assistance straightforwardly and practically.

Three things are guaranteed to take place hundreds of times every day in any pawnshop: When people borrow money, they typically pledge an asset of some kind as collateral for the loan. Used goods are traded between individuals. People purchase both brand-new and previously owned items.

How do Pawnshops Make Money?

Personal Loans

The interest gained from the loans given out to customers is the primary source of revenue for pawnshops. Pawnshops are businesses that provide financial assistance to customers in exchange for the pledge of an object of value, such as a television or computer, as security for a loan.

The amount of money a pawn shop is willing to loan primarily depends on the worth of the item being pawned. Still, the amount of inventory the business currently has can also substantially impact the amount. Suppose the pawnshop has many similar televisions on its list, for instance. In that case, it will typically offer to lend significantly less money than it would if it had a small number of televisions in its inventory. This is in contrast to when the pawnshop has a small number of televisions in its stock.

Pawnshops typically charge interest rates on personal loans that are several times greater than the rates offered by traditional financial institutions. The danger of default is significantly increased because most people seeking loans from pawnshops cannot meet the requirements for conventional bank loans. Pawnshops' interest rates often range from 5% to 25%. State laws determine the interest rate pawnshops can set, and the regulations governing these businesses can vary significantly from one state to the next.

The standard payment schedule for loans is monthly or 30 days. After each month, the loan term is prolonged by one further month if the borrower pays back the principal amount plus the interest accrued during that month. However, if the borrower makes the monthly interest payment, the loan will not be extended for another month, even if the total amount is paid.

Reselling

Additionally, revenue can be generated for pawnshops through retail sales. This includes items that the pawnshop has purchased outright from private individuals and things that customers have pledged as collateral for loans that they have subsequently defaulted on. Pawnshops would often offer a little higher amount of money to purchase an item outright as opposed to when they offer loans secured by the item as collateral for a loan. Pawnshops can more correctly forecast their profit margins since they are aware that they will be able to resell things promptly and are paying a higher price. This additional money, which can vary anywhere from 10% to 15% more, is a result of this knowledge.

This is because both variables are the heart of the products and the amount of time they gave before the loans went into bankruptcy. A pawnshop may have already made a profit even though the loan has not yet been considered in default. This is possible because the pawnshop collected the interest payments made before the loan was considered defaulted. In addition to the passage of time, the item's value may have decreased to such an extent that it is currently worth neither anything nor very little when resold.

Additional or Auxiliary Services

Several pawnshops have begun instituting a fee structure for the supply of supplementary services to grow their businesses' overall revenues. Pawnshops typically offer various financial services, such as check cashing, mobile phone activation, money transfers through Western Union, and bill payment services. Pawnshops have the potential to double as shipment locations for delivery companies such as FedEx and UPS in some instances.

Conclusion

They are willing to offer more money to purchase items outright than they are ready to lend against the items. This additional money can range anywhere from 10 to 15 percent. The things that the business ultimately obtains through loan defaults may bring them larger or lesser earnings, in the end, depending on the items, as well as the length of time that the loans were carried previous to the default.

Introduction to Law of Supply and Demand

Questions to Ask a Realtor

Ways to Get Fast Cash

Employee Attendance Management: 6 Strategies to Boost Productivity

Top-Rated Funeral Coverage Providers

FX in APAC: Key Insights and Implications for Regional Businesses

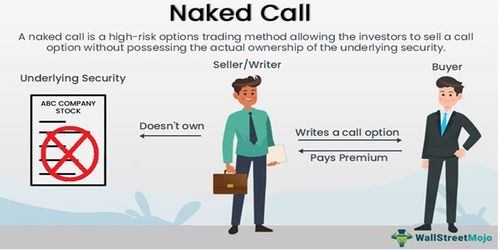

Naked Call Writing: A Comprehensive Guide

Commoditization of Cryptocurrency

Can You Really Go to Jail for Debt

Difference Between Mortgage Lenders vs. Banks

Virginia First Time Home Buyer