Trading Options

Nov 12, 2023 By Susan Kelly

Roth IRAs are a well-known method of accumulating wealth. By paying tax on the contributions they make today, they can save the tax due on their capital gains later on. It's a beneficial option for those who believe they will likely increase as they age. Of course, the Roth IRAs are still subject to certain regulations like traditional IRAs with restrictions on withdrawals, limitations on the types of securities they can use, and a trading strategy. Below, we'll take an in-depth look at the usage of Roth IRAs' options and some crucial factors to keep in mind.

What Are Options?

Options contracts grant holders the option--but not the obligation -- to buy or sell the security at a predetermined price and time, referred to by the term "expiration" date. Every option contracts are the buyer, who pays a fee to obtain the rights granted by the contract--and a vendor that "writes" the agreement and gets cash directly from the purchaser.

This is the amount at which the option contract can be purchased, transferred, or exercised. The gap between the stock's underlying value and strike prices determines the option's value. For instance, for buyers of call options, the contract is out of the market (OTM) if it is higher than the value of the stock in question.

Use of Options in a Roth IRA

The first question investors may ask is: Why would anyone need to consider using options for retirement accounts? Unlike stocks, options could reduce their value if the security value does not reach the strike price. This makes options riskier than bonds, stocks, or mutual funds typically found within Roth IRAs.

Although options are indeed a risky investment, however, there are a variety of situations that could be a good fit for retirement accounts. For instance, put options could protect an investment in a long-term stock portfolio against the risk of short-term volatility by locking the option to sell it at a particular price. Additionally, covered call strategies are a way to earn income if investors don't mind having to sell their stocks.

For example, suppose you are a retired investor with an extensive portfolio in S&P 500 index funds. The investor might believe that the economy needs an economic correction but may be reluctant to sell the entire portfolio and shift to cash. An alternative is to protect the S&P 500's exposure by using put options that provide an assured cost floor over a specific time.

Roth IRA Restrictions

Many of the more risky strategies associated with options aren't allowed for Roth IRAs. In the end, retirement accounts were designed to aid individuals in saving to retire rather than becoming an investment vehicle for risky speculations. The investor should be aware of these limitations to avoid encountering issues that could lead to the potential to be costly.

Internal Revenue Service (IRS) Publication 590 outlines various prohibited transactions restricted to Roth IRAs. The most significant one stipulates that assets or funds inside the Roth IRA may not be used to secure loans. Because it relies on account assets or funds as collateral and is a form of margin trading, it's generally not allowed in Roth IRAs to comply with IRS tax regulations (and to avoid penalties).

Roth IRAs also come with contribution limits that could hinder depositing funds to pay the margin call, which puts additional restrictions on using margins within retirement accounts. The limitations for 2021 and 2022 will be $6,000 for those younger than 50 and $7,000 for those who are 50 or more. However, these limits do not apply to rollover contributions or qualifying Reservist repayments.

Trading Options in Roth IRA

Brokers also have rules on the types of options trading allowed within the Roth IRA. For instance, Charles Schwab requires a minimum balance of $25,000 to be able to trade spreads. Some brokers might provide restricted margin accounts where certain transactions which normally require margins are permitted only on a limited basis.

These strategies require approval for options and option levels of trading from the IRA custodian. Most of brokers have 3 to 6 levels of trading, and the lower ones permit strategies with lower risk, while higher levels permit more risky trading. Thus, the point that an investor is authorized determines the sophistication of the options strategies they can use, which means that certain strategies could not be available to investors.

Questions to Ask a Realtor

Affect of Climate Change On Companies

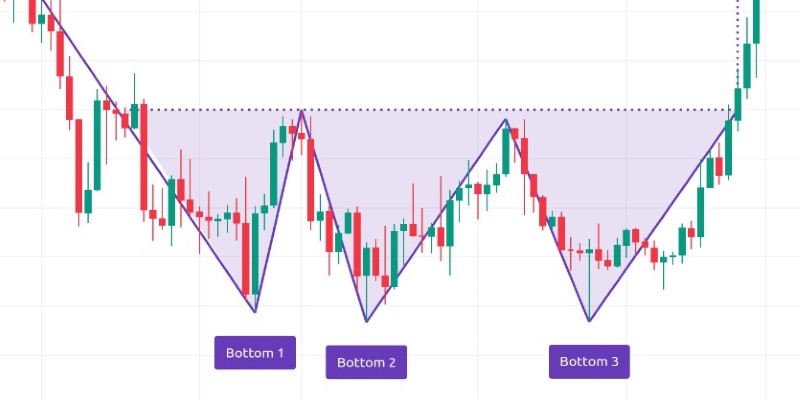

From Bearish to Bullish: How to Trade the Triple Bottom Chart Formation

Virginia First Time Home Buyer

FX in APAC: Key Insights and Implications for Regional Businesses

Making The Most Of Your HSA At Every Life Stage

How To Present A Gift Of Shares Of Stock

Funding Home Improvements: Qualifying for an FHA Loan

Trading Options

How do I get out of secured debt?

5 Life Insurance Options You Should Consider