Other benefits of CBDC that the central bank has taken into account

Oct 08, 2023 By Alan Foster

3. Maintain competition, efficiency and innovation in the field of payments

The change of payment behavior suggests that consumers will eventually take the most convenient way to pay, such as using a credit card. Although these payment methods may cause higher costs to enterprises, these costs will ultimately be passed on to consumers. If CBDC can provide greater convenience in transactions at a lower cost through continuous development, consumers and enterprises will benefit from it.

4. Meet the payment demand of the future digital economy

If CBDC can make small transactions at a lower cost than they are today, the number and frequency of these transactions will increase dramatically, leading to the development of new services that can take advantage of this function. This may lead to new business models, such as paying for digital media (for example, paying a few pence each time of individual news articles, rather than having to sign up for monthly subscriptions)

5. Improve the availability and use of central bank money

As a risk-free currency form, the currency of the Bank of England (whether cash, reserves or CBDC that may be introduced) provides the final settlement means for all sterling payments in economic activities and plays a fundamental role in supporting monetary and financial stability. Therefore, CBDC needs to be carefully designed to reduce its impact on monetary and financial stability.

6. Mitigate the adverse consequences of reduced cash use

Cash provides a certain degree of privacy protection in transactions, but the existing electronic payment systems do not always provide the same protection. CBDC should protect users' privacy to a greater extent than the existing payment system, but it must comply with relevant legal provisions, especially those on anti-money laundering. CBDC is not a substitute for cash, but an important supplement to it.

7. Promoting cross-border transactions

For many users, cross-border payment is expensive, slow and opaque. CBDC will provide better cross-border payment services as a safer and faster payment method. The Bank of England has participated in the cross-border payment task force of the Committee on Payments and Market Infrastrutures (CPMI) and will provide support for the G20 to improve cross-border payment.

On this page

Affect of Climate Change On Companies

Explain in Detail: What Is a Financial Planner?

Ways to Get Fast Cash

Capital Dividend Account

FX in APAC: Key Insights and Implications for Regional Businesses

How do I get out of secured debt?

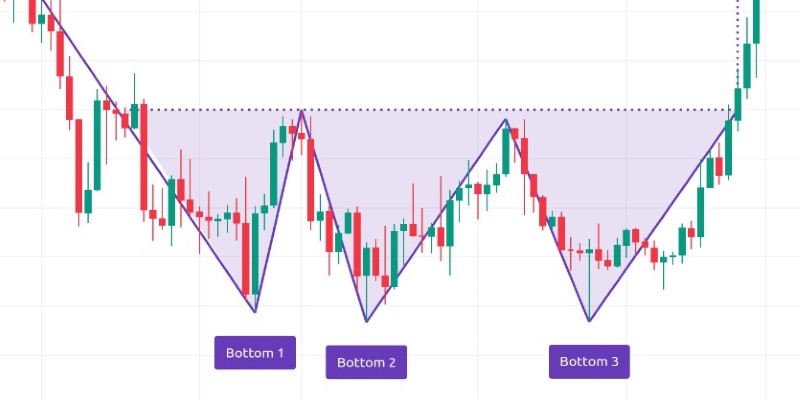

From Bearish to Bullish: How to Trade the Triple Bottom Chart Formation

Funding Home Improvements: Qualifying for an FHA Loan

Gross Debt Service Ratio

Should You Settle Your Debts for Less Money?

Other benefits of CBDC that the central bank has taken into account