Explain in Detail: What Is a Financial Planner?

Feb 22, 2024 By Susan Kelly

Introduction

What Is a Financial Planner? A financial advisor can help you map out your financial future, from setting savings goals and creating a budget to reducing your tax liability and planning for your family's financial security. Here's what you need to know about hiring a financial planner. Many financial planners target a particular demographic, such as millennials or retirees, and offer services including tax planning, asset allocation, risk management, retirement planning, and estate planning. Financial planners help their clients with various issues, including retirement and college savings, investment management, and starting and growing a business with minimal financial risk.

What Does a Financial Planner Do?

To achieve your financial objectives, it is recommended that you seek the assistance of a financial advisor. Planning for the future is essential, whether you're looking to buy a house, save for retirement, provide for your children's college education, or figure out what kind of insurance you need. A financial planner will examine all facets of your life to determine how you may best allocate your resources to meet your objectives. To this end, they may recommend methods for reducing debt, appropriate investments for retirement funds, and other products and services to help you reach your goals more quickly and conveniently.

Do You Need A Financial Planner?

In most cases, the need for a financial planner increases in proportion to the complexity of the client's financial condition. DIY methods can be effective when dealing with relatively straightforward budgets. However, financial planners can provide an unbiased viewpoint and expert knowledge to decisions like how to invest your money, what to prioritise, and what kind of insurance and other safeguards you need to protect your finances. The need for the services of a financial planner increases when major life events like marriage, divorce, or the receipt of inheritance occur.

Types Of Financial Planners

Your needs, current situation in life, and available resources will determine which style of a financial planner is ideal for you. In the following, we'll discuss a few possibilities.

Robo-Advisors

If you're just getting started with investing, a Robo-advisor might be all you need. Automation has allowed traditional institutions like Vanguard and Fidelity and online-only services like Betterment and Wealth front to lower the cost of portfolio management drastically. One of these companies may be a suitable fit for you if you need assistance with your investments but aren't searching for complete financial planning services.

The top Robo-advisory services will build and manage a portfolio of low-cost assets specifically suited to your financial goal for a fee of 0.25 percent of your account balance or less. The computer will adjust the portfolio's allocation when necessary, using a formula it was programmed with. The minimum opening balance for a trading account is $500. Because of their low cost and ease of use, Robo-advisors help you work toward your financial goals with less difficulty. It's vital not to avoid the market because doing so will drain your retirement funds.

Traditional, In-Person Financial Planners

Personal, in-person financial planning services may be the best option for those with more complex or long-term planning needs. Regardless of how complicated your financial situation is, a Certified Financial Planner can help. To earn the Certified Financial Planner (CFP) credential, a provider must complete extensive coursework and pass an examination.

A fee-only CFP may charge a fixed rate of $1,000 to $3,000 or more for a specific project. It is not uncommon for investment managers to charge a percentage of your total portfolio value each year; this is known as an "assets-under-management fee" and is commonly 1 percent. Typically, the cost of the first meeting to discuss your requirements and their services is nothing. It's important to know whether or not the individual you're thinking of working with is a "fiduciary," a person who is legally bound to act in the client's best interests.

Online Financial Planning Services

Several websites offer comprehensive financial planning services, including automated portfolio management and direct contact with real people who can answer questions and offer advice. Many financial planning services provide professional planners and thorough plans, but meetings take place over the phone or online instead of in person. The fees for such online planning services are often higher than those of a Robo-advisor but lower than those of a human financial planner.

What Is the Difference Between a Financial Planner and a Financial Advisor?

However, not all financial advisors may be considered financial planners. Financial planners provide services to assist people and businesses create sustainable financial futures. An advisor's area of expertise could be anything from investing and taxes to retirement and estate planning. The term "financial advisor," which includes CFPs, is more general. Financial, investment, stock, and fund management, as well as estate and tax planning, are all areas where they may be employed to assist clients.

Conclusion

Experts in financial planning assist people, families, and even businesses in meeting their immediate and future monetary objectives. Some financial planners out there whose acting skills leave something to be desired. Before you start a partnership with a financial planner who will have access to private financial information, examine their credentials and disciplinary history. Warning signs include the existence of complaints lodged against them.

Business Automobile Policy

Questions to Ask a Realtor

Debt Collection: Is There a Statute of Limitations?

Making The Most Of Your HSA At Every Life Stage

Virginia First Time Home Buyer

Top-Rated Funeral Coverage Providers

5 Life Insurance Options You Should Consider

Trading Options

Understanding Market Research - A Comprehensive Guide

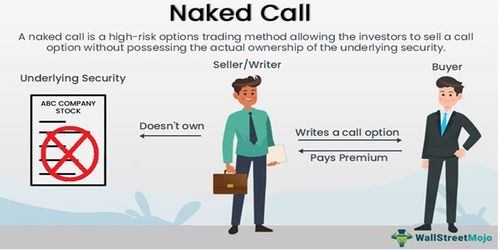

Naked Call Writing: A Comprehensive Guide

Bureau of Labor Statistics Explained: Functions and Operations