How Economic Volatility Affects Your Investment Portfolio

Sep 30, 2024 By Susan Kelly

During economic transformations, people who invest experience increased unpredictability and possible disturbances in their financial collections. This could be due to a slump in the economy, an increase in prices, or changes at international level markets. It is vital to comprehend how these elements impact the worth and functioning of investments. Being able to predict risk for a portfolio and making appropriate modifications can assist in reducing damage as well as taking advantage of positive situations. In this article, we are going to look into tactics for controlling the risk of a portfolio during changes in the economy. We will provide knowledge on how persons investing can safeguard and increase their wealth despite an unstable environment.

Understanding Portfolio Risk in an Uncertain Economy

The idea of portfolio risk is about the chance for investments to become less valuable because of different reasons like market changes, political events worldwide, or modifications in economic rules. When economies go through good and bad times, the degree of danger in a portfolio varies too. In an economy that's growing bigger slowly but surely risks may appear smaller due to stable growth and trust from consumers. But, when there is a downturn or financial crisis, the risks become higher because stock prices, bond yields, and other investment vehicles react negatively.

When markets start showing uncertainty, it turns vital for investors to grasp the nature of threats their investments are prone to. These may embrace market threat, credit danger, interest rate peril, and inflation jeopardy. Correct assessment of these hazards certifies that investors don't get caught off guard by abrupt declines. Understanding how the risk in a portfolio operates is the initial move toward making educated modifications that can safeguard against losses.

- Market Correlation: Understand how different investments are connected to mitigate cascading losses.

- Risk Layers: Assess each investment for multiple risk factors, such as liquidity or credit risk.

The Impact of Economic Changes on Investments

Changes in the economy can cause different impacts on various asset types. When the economy grows, usually stocks perform well because businesses earn more profits and the trust of investors increases. On the other hand, during economic downturn periods, assets like bonds and commodities might become safer places for investment as investors tend to move toward less unpredictable options.

Within an economy that is constantly changing, inflation becomes a primary worry. This is especially true for fixed-income assets like bonds. The value of future bond payouts lessens when there's rising inflation, causing potential losses for those investors who are heavily dependent on such investments. However, some assets can benefit from high inflation; commodities and real estate are examples of these as they usually keep their worth in settings with high inflation rates. Knowing the impact of each economic stage on different assets allows investors to plan their portfolio distribution better, reducing risks from sectors that are not performing well.

- Inflation Impact: Consider inflation-sensitive assets like real estate for inflation protection.

- Interest Rate Movements: Keep an eye on central bank policies as they affect bond yields significantly.

Diversifying to Mitigate Portfolio Risk

The practice of diversification still stands as a very trustworthy way to control risk in the portfolio, particularly when the economy is not stable. When investments are shared across many different types of asset classes, like shares, bonds, property, and commodities - it decreases the chances that bad results in one place will have serious effects on their total investment collection.

When there is trouble in the economy, having a variety of investments can help protect against certain market problems. When shares are decreasing because of a financial downturn, putting money into things like gold or bonds from the government might make up for those losses. This happens because these usually do better during hard times. The important thing to remember is that not only should you invest your money across different types such as stocks and bonds but also within them, like owning both local and international shares, or long-time and short-term.

- Asset Mix: Evaluate your exposure to various sectors and geographies for stronger diversification.

- Counterbalance Risks: Include assets like gold or treasuries for balance during stock market declines.

Evaluating Risk Tolerance in Changing Markets

All investors possess a distinct level of risk tolerance, referring to their capability and readiness to bear losses for potential profits. Shifts in the economy frequently challenge this tolerance since the value of portfolios varies more often in unstable markets. Investors must reevaluate their capacity for risk occasionally, specifically during periods when the economy is turbulent.

People who can handle high risk may feel okay to keep risky things like shares, even when the market is down. They believe that markets will go up again after some time. But people who cannot take much risk, like those about to retire or already retired, might want to focus on saving their money instead of trying for higher profits. Knowing how much risk you can tolerate helps investors make changes according to their financial aims and ensures they manage the level of danger in their investment portfolio no matter what the economy's state is.

- Periodic Review: Reassess your risk tolerance regularly, especially during significant market changes.

- Risk Profile: Align your portfolio based on personal financial goals and time horizons.

Adapting Risk Management Strategies for Volatile Markets

Strategies for controlling risk need to have flexibility, mainly in a changing economic situation. One way that works well is by rebalancing. This means making periodic changes to how assets are distributed within an investment collection, to keep at a level of risk that is preferred. Suppose there are too many stocks filling up someones set of investments during a time when the stock market doing very well. Then they can do some rebalancing by selling off part of their stocks and buying bonds or other items that don't change value as much.

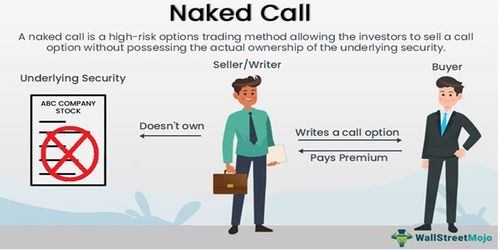

A different approach is known as hedging. This technique seeks to balance out possible losses by adopting a contrary stance in an associated investment. As an illustration, someone who possesses vast quantities of stocks in foreign currency could hedge against the risk related to currency by owning positions within derivatives of foreign exchange. Yet, it's vital to remember that while hedging can help safeguard from losses, it carries its dangers and expenses too. Therefore, hedging should be used judiciously, particularly when anticipating major economic shifts.

- Hedging Costs: Keep in mind that hedging strategies come with added costs that must be justified.

- Rebalancing Frequency: Review your asset allocation every quarter or after significant market movements.

Looking Ahead - Preparing for Future Economic Changes

Expecting portfolio risk in an evolving economy includes both immediate changes and long-term strategy. Although we cannot foretell precisely how and when economic alterations will happen, investors can prepare themselves to react appropriately. Being up-to-date about worldwide economic patterns, variations in interest rates, and data on inflation lets investors predict possible market disturbances and act before major losses happen.

Furthermore, investors must always check their investments to make sure that how they spread out their assets and manage risk is still in line with what they want financially. This process means watching the performance of each investment while also being aware of larger economic signs that might signal a need for changing the portfolio. Being proactive about managing portfolios during times when the economy changes can help investors stay strong, no matter what happens in markets.

- Global Trends: Stay updated on global economic trends and adjust portfolios accordingly.

- Long-Term Focus: Balance short-term adjustments with long-term financial goals for sustained success.

Conclusion

To manage portfolio risk in a changing economy, it is necessary to fully understand how different economic stages affect the performance of investments. Through diversification of assets, checking risk acceptance, and adjusting strategies for managing risks, investors can keep their portfolios safe from instability and take advantage of openings that come up during periods of economic doubtfulness. Even though the economy might be hard to predict, keeping an adjustable well-informed approach towards investing helps secure long-term financial prosperity.

On this page

Understanding Portfolio Risk in an Uncertain Economy The Impact of Economic Changes on Investments Diversifying to Mitigate Portfolio Risk Evaluating Risk Tolerance in Changing Markets Adapting Risk Management Strategies for Volatile Markets Looking Ahead - Preparing for Future Economic Changes Conclusion

Naked Call Writing: A Comprehensive Guide

Should You Settle Your Debts for Less Money?

Explain in Detail: What Is a Financial Planner?

Making The Most Of Your HSA At Every Life Stage

Funding Home Improvements: Qualifying for an FHA Loan

Introduction to Law of Supply and Demand

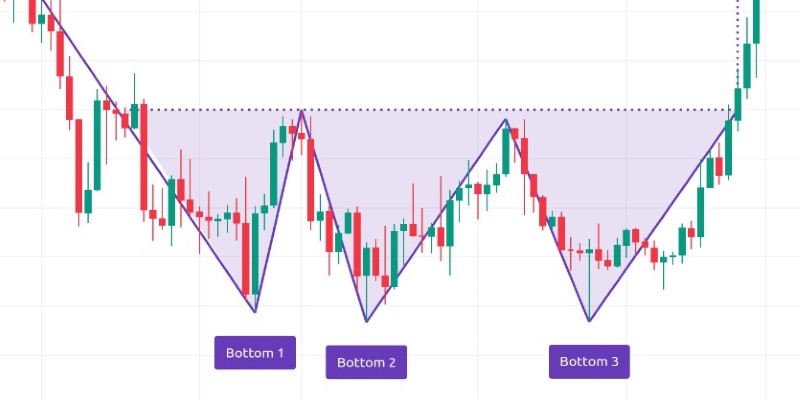

From Bearish to Bullish: How to Trade the Triple Bottom Chart Formation

Trading Options

Ways to Get Fast Cash

Debt Collection: Is There a Statute of Limitations?

How Economic Volatility Affects Your Investment Portfolio