Should You Settle Your Debts for Less Money?

Dec 30, 2023 By Susan Kelly

An account cancellation completed in good standing might remain on your credit report for up to ten years (meaning no late payments). Your credit score will improve if you continue a solid payment history on those accounts. The longer you've had credit, the more likely it will help your credit score.

If you are ready to negotiate with the lender, you may be able to settle the debt for a sum less than the total amount owing. Debt settlement companies offer to negotiate with your creditors on your behalf for a fee. Still, such services have significant hazards, such as serious harm to your credit and high charges. Instead of negotiating with lenders on your own, you might find it easier to follow a debt management plan prepared by a non-profit credit counselling organisation.

Debt Repayment Methods

Several options are available for paying off a debt that has not yet been turned over to collections. It will help if you start by knowing exactly how much money you owe and how much interest you are now paying on that loan. Debts with the highest interest rates should be paid off first (the debt avalanche strategy), but if paying off the smaller bills first will keep you more motivated, then do it instead.

Consolidating your debts into one loan with a single monthly payment simplifies your financial life and may even cut your interest rates. Additionally, you may apply for a bill transfer credit card if you qualify. With one of these cards, you can consolidate your existing credit card debt into a single monthly payment and enjoy interest-free financing for a specified time while you pay it off.

Suggestions for Seeking Out Extra Debt Relief

Although tackling your debt may seem overwhelming and complicated at first, many valuable resources can assist you. Again, a non-profit credit counselling agency is an excellent place to begin, as they often provide free initial consultations and advice on managing your finances better and paying down your debt. If you need help with debt collectors or debt-related litigation, you can use the Legal Services Corporation's online search tool to get free local legal assistance.

Knowing Your Debt Repayment Options

Paying off the debt that has gone to collections is preferable to settling it, but either option is better than doing nothing. You have gone a long way to get where you can take care of your debt and eliminate it. Debt freedom is a worthy and attainable goal, even if it may take time and effort.

When an account that has been sent to collections is paid off or settled, it is not necessarily reflected in the credit score. Older versions of the FICO® Score model will still take into account the collection account, even if it is paid in full, for a full seven years after the account has been opened.

The Pros and Cons of Debt Consolidation Loans

Although they may still be making payments, however infrequently, consumers who participate in a debt settlement programme owing to excessive debt have less bargaining leverage than those who have made no payments at all. Therefore, they should take the initial step of stopping all payments immediately. It's possible that your credit score will drop due to the debt settlement process, especially in the beginning, warns Freedom Debt Relief co-president, Sean Fox. After a client begins making payments on settled debt, their credit score should improve.

If you fall behind on payments and settle the debt for less than you owe, it will devastate your credit score. It may fall to below-average levels, somewhere in the 500s. You had a higher pre-fall score if the drop was more significant. If you're ever late with a payment, it might stay on your credit report for seven years.

Debt settlement vs. minimum monthly payments

Clients looking to cut costs should avoid making the minimum payment on high-interest debt. This can take a few years to a few decades, depending on how much debt one has and the current interest rate. If you can only afford to make the minimum payment each month, you will never be able to get ahead of the daily interest on your outstanding balance.

Although a strong payment history helps boost your credit score, paying only the minimum each month and forking out high-interest charges may make you a very profitable debtor for your creditors. Still, if you can help it, avoid spending money on interest. Rather than a high credit score, a sizable nest egg is the surest way to retire comfortably.

5 Life Insurance Options You Should Consider

Commoditization of Cryptocurrency

How to Sell on Poshmark: A Complete Guide

Questions to Ask a Realtor

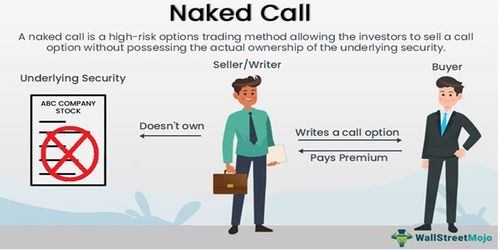

Naked Call Writing: A Comprehensive Guide

Bureau of Labor Statistics Explained: Functions and Operations

Business Automobile Policy

Virginia First Time Home Buyer

PNC Auto Loan Offerings: An Overview

Making The Most Of Your HSA At Every Life Stage

Trading Options