Capital Dividend Account

Oct 01, 2023 By Susan Kelly

The Capital Dividend Account (CDA) together, alongside corporate funds, maybe a great method for shareholders of a Canadian company to earn tax-efficient earnings. From a tax standpoint, it can be beneficial for a company to make capital gains instead of interest income to decide when these capital gains will be recognized and have the profits flow through the CDA. Capital gains are an efficient form of investment income suitable for corporations (and individuals) because they are tax deductible at only 50 percent. Interest income isn't eligible as a taxable addition to the CDA.

Understanding CDA

Capital dividends are an example of an organization's payment to its shareholders. The money is taken from capital paid in, not retained earnings, as are the normal dividends. If capital dividends are distributed to shareholders, they are not tax-deductible because dividends are seen as an exchange of capital that investors invest.

If a business earns a capital gain through the disposal or sale of an asset, 50% of that gain will be subject to capital gains tax. The portion that is not tax-deductible of the total gain realized by the company is credited in CDA. This account forms an element of a tax policy designed to allow tax-free cash that a business receives to be distributed to its shareholders tax-free. Thus, shareholders aren't obliged to pay tax on these dividends. So long as the business has this account in its notional form, it can designate the adequate amount of dividends to be capital dividends.

The amount in the CDA is increased by 50 percent of capital gains made by a business and is reduced by 50% of capital losses incurred by the business. The company's CDA will also increase when other corporations give capital dividends to the company. A business that receives proceeds from life insurance over its cost base of insurance will see the extra value added to the CDA balance. In addition, the distributions made by trusts to a business at the close of the trust's tax year will increase the balance of the capital dividend account of a company.

Capital dividends can only be declared when it is proven that the CDA account is positive. Any company that distributes dividends to its shareholders a sum greater than the amount in the CDA is at risk of a significant tax penalty equal to 60 percent of the over dividend. This CDA account balance cannot be included in the company's financial statements but could be included as a note to the statements of financials for informational purposes only.

Capital dividend accounts are often utilized in Canada. A shareholder who is a non-resident of Canada is required to pay a flat rate of 25% withholding tax on capital dividends they receive. The withholding tax may be decreased if the dividend is given to a shareholder who lives in one of the countries with an agreement on taxation with Canada. For instance, a U.S. shareholder who receives an investment dividend from a Canadian company is subject to a tax withholding that is 5 percent. Additionally, investors who are not residents will most likely be taxed by the tax laws of the country of their residence.

How Does a Capital Dividend Work?

CDA is a separate account that corporations use to give shareholders tax-free dividends. It is a special account that allows shareholders to receive tax-free dividends. Capital Dividend Account does not appear on the balance sheet. It can be found in financial statements reports. However, it is not listed in the reports of financial statements. Although the account is secret, shareholders will need to be aware of it since it provides an exceptional tax benefit in that they can withdraw the company's funds without paying any tax. Thus, shareholders can receive a tax-free income dividend when their account balance is positive. Canada, CDAs are typical to aid shareholders and businesses in segregating the seed capital from the profits.

Additionally, they permit shareholders to determine which tax-deductible dividends are not tax-deductible. The taxation principles are strictly followed through the CDA. This principle demands that every individual pay an equal tax, regardless of whether their earnings are directly earned or through the company. Dividends are usually paid at lower rates due to this concept. Capital dividends are paid out of your company's capital dividend accounts that are part of a CRA account that is analyzed by the data filed on the tax return for the corporate income of the corporation.

How To Present A Gift Of Shares Of Stock

Debt Collection: Is There a Statute of Limitations?

How do I get out of secured debt?

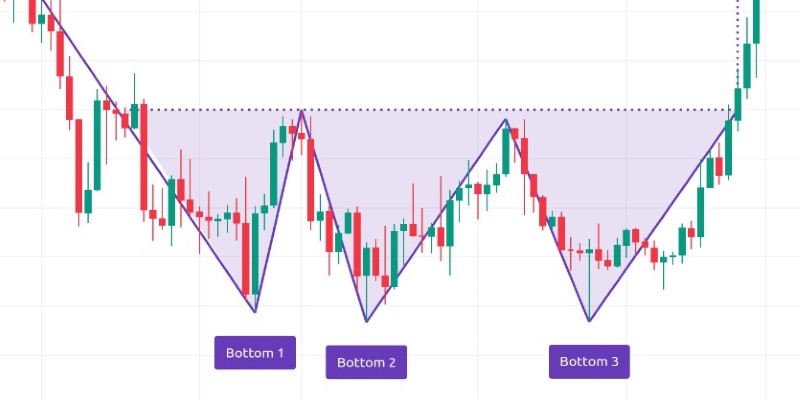

From Bearish to Bullish: How to Trade the Triple Bottom Chart Formation

How to Sell on Poshmark: A Complete Guide

FX in APAC: Key Insights and Implications for Regional Businesses

Affect of Climate Change On Companies

Understand and Learn: How Pawnshops Make Money?

Understanding Market Research - A Comprehensive Guide

6 Ways to Get a Free Google Ads Promo Code in 2024 – A Comprehensive Guide

How Economic Volatility Affects Your Investment Portfolio