Difference Between Mortgage Lenders vs. Banks

Oct 31, 2023 By Susan Kelly

Mortgages may be obtained from various sources, the most frequent of which are huge financial organisations like JPMorgan Chase and Wells Fargo, as well as specialised non-bank mortgage lenders like Quicken Loans and SoFi. Because each one provides something others don't, the one you choose can rely on the things most important to you.

Difference Between a Mortgage Lender and a Bank

After the closing, the mortgage loan you have taken out might be sold to another lender. Suppose your credit history, income, and existing obligations are sufficient. In that case, mortgage lenders and banks alike may be able to assist you in obtaining the financing you want to complete the purchase of your new house. However, each comes with its own set of benefits and drawbacks. Mortgage lenders often provide borrowers with a wider selection of loan possibilities, and they may be more lenient with customers who have credit that has been harmed. Banks often provide fewer loans and have more stringent requirements for lending money.

Which Is the Best Option for You?

If you already have a connection with a financial institution, it may be the simplest option for you to contact a local banker to help you with the process of obtaining a house loan. On the other hand, specialised mortgage lenders are gaining a larger and larger portion of the market for house loans due to the flexibility and speed with which they close loans.

Advantages and disadvantages of Banks

Current account holders at a bank may often take advantage of additional perks or savings opportunities offered by the bank. It is possible that they may have unique in-house lending choices tailored to certain buyer groups, like purchasers who are self-employed or investors. Financial institutions may attempt to upsell customers onto other goods and services during the loan application process to increase overall income. This could include supplying certain savings or checking accounts, credit cards, or other items in return for mortgage conditions more beneficial to the borrower.

The most significant drawback of bank loans is that they often come with more stringent lending rules than other types of loans. This is because banks are subject to federal compliance and reporting regulations. Suppose you have less-than-perfect credit or a significant financial catastrophe (such as foreclosure or bankruptcy) on your record. In that case, this may make it more difficult for you to qualify for the programme. Additionally, the closing process for a bank loan is often more time-consuming.

Pros

- Have the potential to have reduced interest rates.

- Could provide current clients with preferential interest rates or other incentives.

- After the closure of your loan, the bank will continue to service your loan.

- They may provide lending schemes that are unique to their industry.

Cons

- Greater stringency in the financing requirements.

- Less different types of lending packages.

- Less mortgage lending competence.

- The increasing compliance requirements have resulted in higher costs.

- The marketing and sale of extra banking products via cross-selling.

- Extended hours till closure.

The Advantages and Disadvantages of Mortgage Lenders

Because these lenders are sometimes subject to less stringent regulations than banks, they can tailor their loan suggestions to the particular monetary requirements of the buyer and their objectives about the purchase of a property. Loan originators working for mortgage businesses are often expected to complete several mortgage-related classes and tests, which provide them with a comprehensive understanding of the industry. Because some of these mortgage lenders are only accessible online, the level of customer care that they provide may not be as attentive to your needs as it is with other lenders.

After the loan closing, mortgage lenders often sell the mortgage servicing rights associated with their loans to mortgage servicing businesses. This implies that you won't have any say in who you pay or collaborate with in the end, despite the fact that your mortgage's interest rates and conditions can't be altered after the sale.

Pros

- More knowledge and experience in lending, as well as training

- Additional borrowing choices

- Improved guidance and advice about loans

- More open to negotiating conditions of the agreement

- Quicker resolution of loan issues

Cons

- There may be no actual site.

- After the closing, the lender has the right to sell your loan to a different servicer.

A Choice That Is the Best of Both Worlds

Authorised mortgage lenders and banks offer the vast majority of mortgages, but there are alternative possibilities, some of which are hybrids of the two types of institutions. You may want to think about working with a financial technology company in addition to a credit union, savings and loan association, or another smaller financial institution.

You might also think about getting the seller to finance your home purchase. This is when the person selling you the house agrees to allow you to pay for it in monthly payments rather than all at once when you buy the house. However, owing to the increased risk that these loans provide to the lender, the interest rates are often greater.

Questions to Ask a Realtor

Gross Debt Service Ratio

Difference Between Mortgage Lenders vs. Banks

Debt Collection: Is There a Statute of Limitations?

Should You Settle Your Debts for Less Money?

PNC Auto Loan Offerings: An Overview

Employee Attendance Management: 6 Strategies to Boost Productivity

How to Sell on Poshmark: A Complete Guide

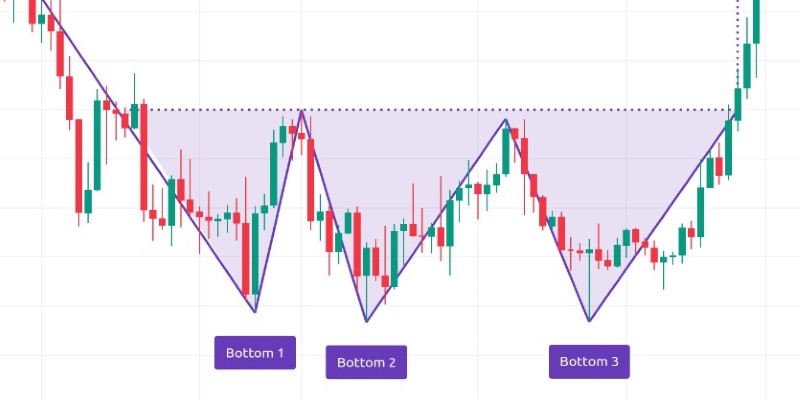

From Bearish to Bullish: How to Trade the Triple Bottom Chart Formation

10 Ways to Improve Your Credit Score After a Foreclosure

Explain in Detail: What Is a Financial Planner?