PNC Auto Loan Offerings: An Overview

Jan 26, 2024 By Susan Kelly

At an annual percentage rate (APR) that starts at 3.3%, PNC auto loans are offered. Your credit history, the loan length, and the loan amount all play a role in the rate you are offered. Depending on the sort of auto loan you require, loan amounts may vary from $5,000 to $100,000, and payback durations can last anywhere from 12 to 72 months. Borrowers who establish automatic payments from a PNC checking account are eligible for a reduction of 0.25% off their annual percentage rate (APR) from PNC Bank. PNC provides the following information to anyone who may be interested in applying for an auto loan:

Finding a Car

You can browse dealer inventories for new and used automobiles using PNC Total Auto. You will also see what other people in your region paid for the same vehicle. Before going to the dealership to purchase the vehicle, you may use PNC's Check Ready Finance to submit an application online and be preapproved in the comfort of your home.

Buying a Car

For both new and used cars, there are PNC bank auto loans. They also provide several loan solutions for borrowers purchasing a vehicle from a dealer or a private seller, purchasing the remainder of their current lease, or refinancing their existing auto loan.

You can apply for a Check Ready Auto Loan via PNC if purchasing the vehicle from a dealer meets the requirements. If your application is granted, a check for your authorized loan will be sent overnight before you go to the dealership. This check will be valid for up to 30 days following the day it was approved. Checks may only be used to purchase new or used automobiles (years 2014 to 2023) from dealerships that have been granted permission to sell such vehicles in the United States by the respective automaker.

The amount of these loans ranges from $7,500 up to $50,000. You must apply for a conventional auto loan if you want a loan amount exceeding the limit. The smallest loan amount is $5,000, and the highest is $100,000 whether you are purchasing from a private seller or buying out of a vehicle lease.

PNC Minimum Borrower Requirements

PNC considers various criteria, including the applicant's credit score, income, and work status, as well as the make, model year, and mileage of the car that is financed. The company does not disclose specific specifics about the criteria for its borrowers; nonetheless, the following are some broad principles.

Credit Score

Your credit score and history are taken into consideration by lenders when determining whether or not to grant you a loan and, if so, on what conditions. If you have poor credit or no credit score, you can have your application rejected or be subject to a higher interest rate.

If you want to purchase a vehicle, you will normally need a credit score of good to outstanding, typically 660 or above. If it is lower than that, you may still be eligible for the loan, but it will come with a higher interest rate. You always have the option to explore acquiring a co-signer to guarantee that you qualify for the loan or to achieve a reduced interest rate.

Debt-to-income Ratio

Your debt-to-income ratio, often known as DTI, will also be evaluated by potential lenders. You can't make additional payments on your car loan if you can't afford to put any of your monthly income toward debt repayment, which is the determining factor.

Add up monthly debt payments and divide that by your total monthly income. This will give you your debt-to-income ratio (DTI) (what you earn before taxes are taken out). Auto loan lenders typically look for a DTI ratio of 50% or below.

Employment and Residency

Lenders will often also consider both your work and the time you have spent living at your present address. They want to ensure that you have a secure job and that you have adapted well to the community in which you reside.

Down Payment

Putting down a deposit on a vehicle informs the dealer that you are serious about making the purchase. Depending on the amount, your down payment might decrease the total size of the loan, lower your interest rate, and even affect the loan term you are eligible for. This all depends on the amount of the down payment that you make.

PNC Auto Loan Fees

PNC Bank claims that there are no origination costs, application fees, or prepayment penalties associated with their loans. But you should always consider additional fees, like the title and the registration, that you will need to pay.

Introduction to Law of Supply and Demand

Debt Collection: Is There a Statute of Limitations?

Explain in Detail: What Is a Financial Planner?

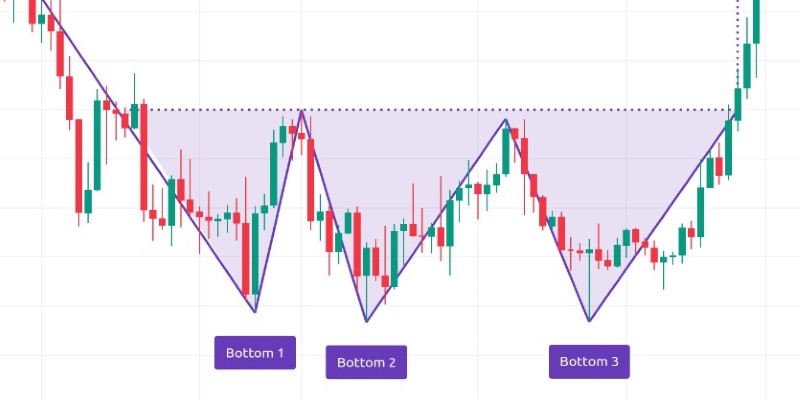

From Bearish to Bullish: How to Trade the Triple Bottom Chart Formation

FX in APAC: Key Insights and Implications for Regional Businesses

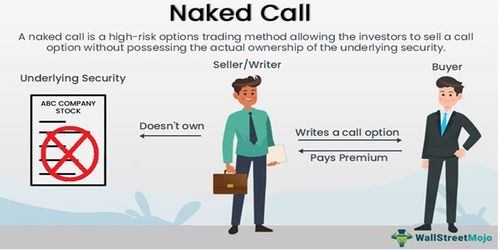

Naked Call Writing: A Comprehensive Guide

How Economic Volatility Affects Your Investment Portfolio

How to Sell on Poshmark: A Complete Guide

Gross Debt Service Ratio

Questions to Ask a Realtor

Understand and Learn: How Pawnshops Make Money?