Commoditization of Cryptocurrency

Jan 19, 2024 By Aynsley Moore

Cryptocurrency is a digital token based on blockchain technology, which can be decentralized without the intervention of a third party such as the government or a financial institution. Cryptocurrency developers build their token system by raising funds through initial coin offerings (ICO). At present, the main problem with cryptocurrency ICO is that it cannot be clearly classified into the two traditional issuance classifications of securities or commodities. Both types of issuance have independent regulatory agencies: the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). The emergence of cryptocurrencies has exposed the divergence of financial market supervision plans under the administration of SEC and CFTC.

A boundary between securities and commodities is important for the classification of cryptocurrency. The investment contract test (Howey test) was first adopted in the SEC v. W.J. Howey Co. case. It establishes four standards to determine whether an agreement is an investment contract, and then whether it is a security. The test can distinguish between commodities and securities, but the novelty of cryptocurrencies blurs the line between them. If cryptocurrency is built on blockchain technology that provides sufficient utility, then it is just a commodity.

On this page

Funding Home Improvements: Qualifying for an FHA Loan

Understanding Market Research - A Comprehensive Guide

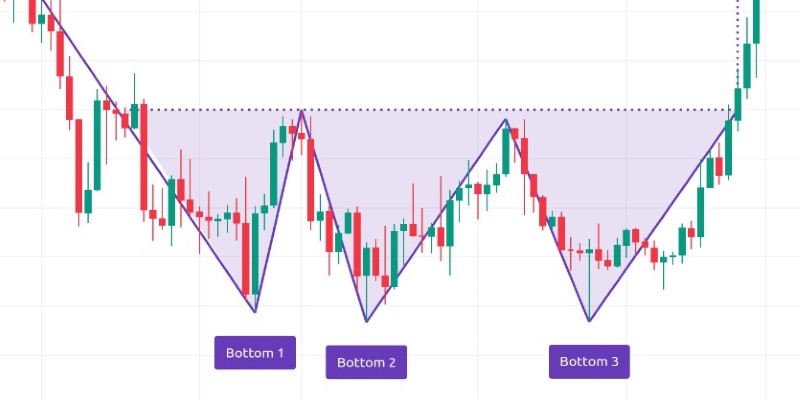

From Bearish to Bullish: How to Trade the Triple Bottom Chart Formation

6 Ways to Get a Free Google Ads Promo Code in 2024 – A Comprehensive Guide

Affect of Climate Change On Companies

5 Life Insurance Options You Should Consider

How To Present A Gift Of Shares Of Stock

Ways to Get Fast Cash

Top-Rated Funeral Coverage Providers

Explain in Detail: What Is a Financial Planner?

Difference Between Mortgage Lenders vs. Banks