Federal Open Market Committee (FOMC)

Jan 02, 2024 By Susan Kelly

FOMC is a Federal Reserve System (FRS) subcommittee responsible for determining the overall course of monetary policy in the United States. This is accomplished via the management of open market operations (OMOs). The committee comprises 12 individuals. They serve on the committee in a rotating fashion.

Understanding FOMC

The Federal Open Market Committee (FOMC) has eight meetings every year at which its twelve members consider whether or not there should be any adjustments to the short-term monetary policy. If a vote were taken to modify the policy, it would result in either the purchase or sale of U.S. government assets on the open market to encourage the expansion of the national economy. Members of the committee are often classified as either hawk, who advocate for more stringent monetary policies, doves, who support stimulus, or centrists/moderates, who are somewhere in the middle of these two extremes. The Federal Open Market Committee (FOMC) leader also leads the Board of Governors. The following individuals currently hold positions on the board:

- On May 23, 2022, Chairman Jerome Powell took the oath of office for a second term on the Federal Reserve Board, which will last four years. In February of 2018, he started his first tenure in this job for the first time.

- Powell is someone who falls within the moderate category.

- Lael Brainard serves as the FOMC's vice chair at this time. On May 23, 2022, she was sworn into the role for a full term that would last four years.

- In June of 2016, she became a member of the board.

- Other Board of Governors of the Federal Reserve System members include Christopher Waller, Lisa Cook, Philip Jefferson, and Michelle Bowman.

- As of May 2022, there is still one open position.

Twelve districts make up the Federal Reserve, each with its own Federal Reserve Bank. These regional banks serve as central bank branches in their respective regions. While the president of the Federal Reserve Bank of New York maintains his position indefinitely, the other Federal Reserve Banks' presidents serve one-year terms staggered throughout a three-year cycle. Each of the following groupings is always represented by one president of a reserve bank on the FOMC's rotating seats, which each have a term length of one year:

- The three locations of Boston, Philadelphia, and Richmond

- The cities of Cleveland and Chicago

- St. Louis, Dallas, and Atlanta are the three cities.

- San Francisco, Kansas City, and Minneapolis are the cities in question.

FOMC Meetings

Each year, the FOMC is scheduled to have eight meetings, but if further gatherings are required, they can hold additional sessions. Since these meetings are not open to the public, there is much speculation about their outcomes on Wall Street. Analysts are trying to determine whether the Federal Reserve will tighten or loosen the monetary policy, leading to an increase or decrease in interest rates. Since these meetings are not held publicly, there is no way to know. In recent years, minutes from FOMC meetings have been made public shortly after the conclusion of such sessions. When you hear in the news that the Fed altered interest rates, that move is the outcome of the FOMC meeting at which they decided to adjust.

During the conference, participants will examine recent events in domestic and international financial markets and make economic and financial projections. All participants, including the Board of Governors and the presidents of the country's 12 reserve banks, discuss their perspectives on the state of the nation's economy and discuss the monetary strategy that would be most advantageous for the nation. Only designated members of the FOMC are allowed to vote on a policy they have determined is suitable for the period after extensive consideration, including all participants.

Operations of the FOMC

The Federal Reserve has the instruments required to expand or contract the money supply. This is accomplished via OMOs, adjustments to the discount rate, and the establishment of required bank reserves. While the Board of Governors of the Federal Reserve System is in charge of determining the discount rate and the reserve requirements, the Federal Open Market Committee (FOMC) is expressly in charge of operating open market operations, which include buying and selling government securities. For instance, the Federal Reserve might put up government assets for sale to reduce the quantity of money readily accessible in the banking system and tighten the money supply.

6 Ways to Get a Free Google Ads Promo Code in 2024 – A Comprehensive Guide

Can You Really Go to Jail for Debt

Introduction to Law of Supply and Demand

Virginia First Time Home Buyer

How Economic Volatility Affects Your Investment Portfolio

Business Automobile Policy

Debt Collection: Is There a Statute of Limitations?

5 Life Insurance Options You Should Consider

Understanding Market Research - A Comprehensive Guide

Questions to Ask a Realtor

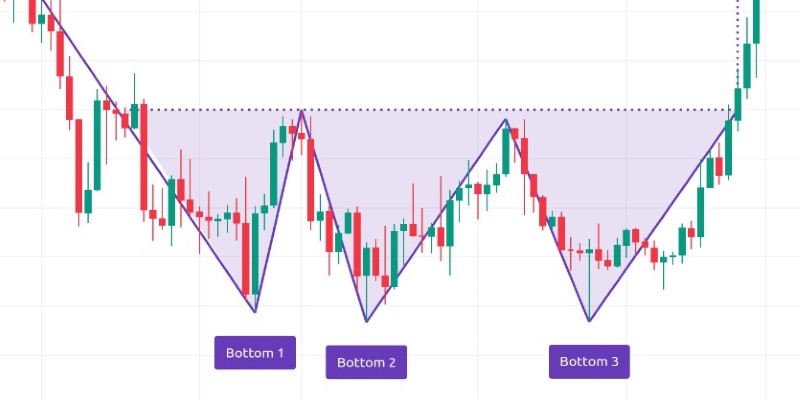

From Bearish to Bullish: How to Trade the Triple Bottom Chart Formation